According to the latest resale market statistics published by the Canadian Real Estate Association (CREA), home sales in Canada dropped by 9% in March. This marks the second monthly decline in a row.

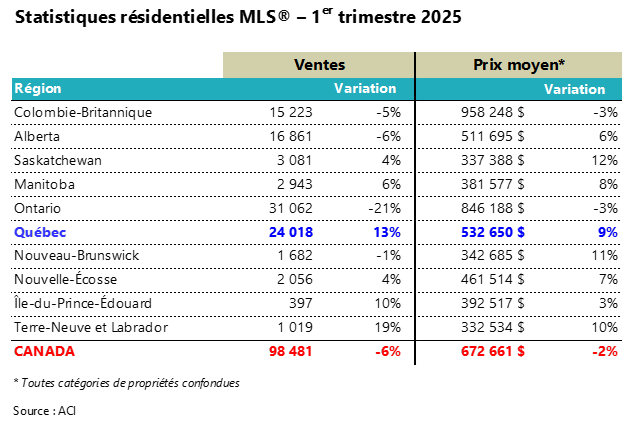

Looking at the first quarter of the year, sales fell by 6% and average prices declined by 2% across the country. Ontario was the hardest hit, with a 21% drop in sales and a 3% decrease in prices. British Columbia also saw prices fall by 3%, even though sales only slipped by 5%.

Quebec continues to stand out… for now

Quebec is going against the trend. Thanks to another 9% increase in sales in March, total sales for the first three months of the year are up by 13%, and the average property price has risen by 9% compared to the same period last year. The metropolitan areas of Montreal and Gatineau led the way, both posting a 14% increase in sales.

Trade conflict changes the outlook

In the meantime, CREA has revised its forecast for the rest of the year. The outlook has darkened because of the ongoing trade conflict with the United States. Beyond the industries directly affected by American tariffs (such as aluminum, steel, auto, and energy — and possibly lumber, dairy, and pharmaceuticals), the overall uncertainty about the duration, impact, and scale of a potential trade war is hurting confidence. Businesses are slowing down their investments. Consumers are worried about job security, planning to spend more carefully, and some are delaying major purchases.

According to a Bank of Canada survey, the percentage of renters planning to buy a home within the next 12 months dropped from 19.9% in the last quarter of 2024 to 16.1% in the first quarter of 2025. In Quebec, it dropped from 14.4% to 10.5% during the same period.

Major downward revision

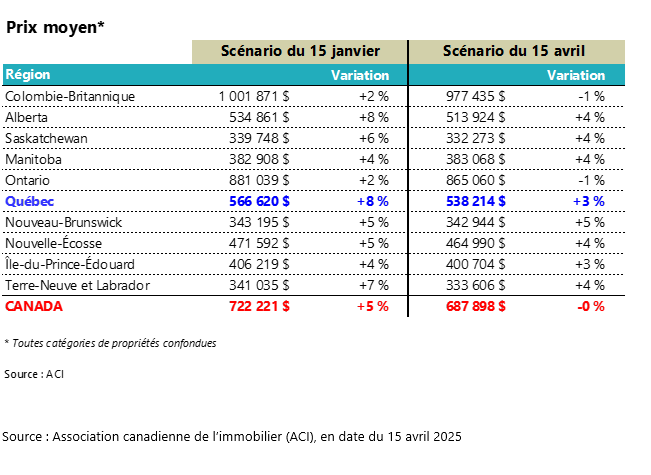

CREA had originally published a forecast on January 15 that didn’t fully account for the risks of a trade war. It now states that “because of ongoing unpredictability and uncertainty about where interest rates are headed, combined with the risk of stagflation, all forecasts are made in a context of unprecedented uncertainty.”

Originally, CREA was expecting national sales to grow by 9% in 2025, along with a 5% increase in average prices. In the updated forecast, both sales and prices are expected to stay flat compared to 2024. Ontario (-4%), British Columbia (-1%), and Alberta (-1%) are expected to see sales decline, but only Ontario and British Columbia are forecasted to experience a 1% drop in average prices.

In Quebec, the revision is minor: sales growth is now expected to be 8% instead of 9%. However, CREA revised its forecast for average price growth from 8% down to 3%. This adjustment seems overly pessimistic to us. We will also be publishing an update to our own forecasts, originally released on December 16.

Source: Canadian Real Estate Association (CREA), as of April 15, 2025.